Our approach

At European Private Markets ("EPM"), sustainability is embedded at the heart of our investment philosophy.

Guided by long-term thinking, our platform manages over €6.5 billion across infrastructure, corporate, and real estate debt, with a clear purpose: to finance the transformation of the European real economy.

We believe that businesses failing to embed ESG into their strategy will face increasing challenges in refinancing and risk losing value over time. We are very committed to management, setting clear social and environmental objectives supported by measurable KPIs.

Our teams treat ESG due diligence with the same rigor as strategic and financial analysis. By integrating sustainability criteria into the way we evaluate and select companies, we aim to ensure the long-term resilience of returns while driving European economy sustainable transformation.

Key figures

of single asset Real Estate financing had an environmental label

low carbon projects financed since 2012 for Infrastructure

ESG indicators for Corporate Direct Lending

Our PRI rating for Direct – Fixed Income - Private Debt

Source: LBP AM, as of 30 September 2025

Our ESG integration is systematic and auditable, spanning the entire investment lifecycle — from sourcing and due diligence to structuring, monitoring, and reporting. Through our proprietary GREaT scoring system and a suite of specialized tools, we assess every opportunity through a sustainability lens tailored to each asset class.

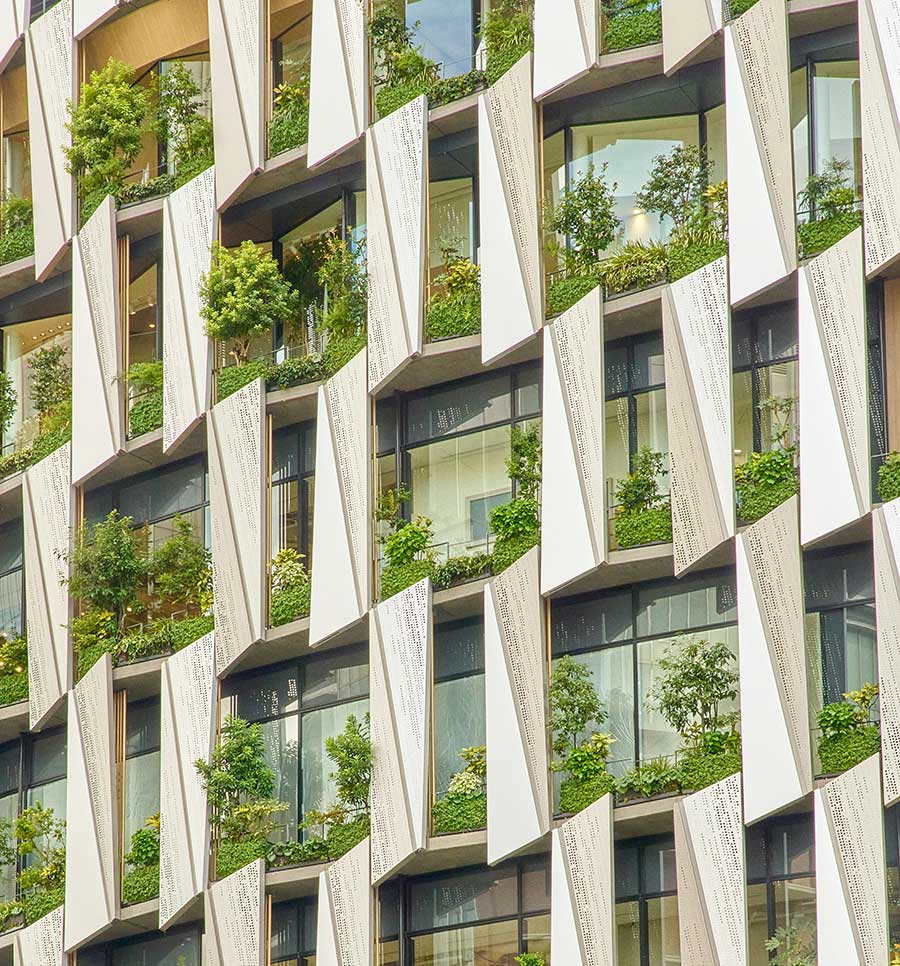

We embed ESG KPIs into financing terms, link margins to sustainability outcomes, and monitor progress with rigor. Whether it’s carbon intensity in corporate debt, taxonomy alignment in infrastructure, or 1.5°C pathways in real estate, our approach ensures that ESG drives both risk-adjusted returns and impact.

Our ESG governance is robust and multi-layered, involving ESG analysts, deal teams, investment committees, and dedicated middle office functions. Together, they ensure methodological integrity, regulatory alignment, and continuous improvement.

With top-tier ESG ratings (100/100 score from PRI assessment in 2025 for Private Debt), a Net Zero ambition at the LBP AM group level, and a strong track record of stewardship, EPM offers investors a platform where performance and purpose align. We don’t just finance projects — we finance progress.

Contributing to four sustainable outcomes

Our contribution and impact within sustainability oriented investment strategies across the EPM platform aim to align financial performance with lasting benefits for competitiveness, environmental resilience, and social cohesion.

When relevant, they encompass and translate the 2030 UN Sustainable Development Goals (SDGs) into investable macro-themes for European communities:

- Energy Transition: financing the decarbonisation of Europe’s properties, energy and transport systems, and industrial bases

- Sustainable Resource management: Enhancing circularity, efficient water and waste management, for a healthy environment and reduced footprint on natural capital

- Digital Transition: Strengthening access to high performance and secure digital infrastructure and services to support productivity and inclusion.

- Strategic Autonomy and Essential Goods and Services: Supporting European businesses and ecosystems that provide accessible essential goods & services to communities, contribute to strategic autonomy, and create resilient jobs.

Policies

& Reports

We are committed to delivering transparent, reliable, and timely disclosures to our investors and stakeholders.